Email is essential for fintech businesses when it comes to communicating with prospects, customers, and partners. In addition to being a deeply niche industry, fintech also comes with the responsibility of handling private user information. Therefore, trust and credibility are, above all else, significant.

If you’re a fintech company with cold outreach campaigns or transactional messages, you’ll want to make sure you have a good sender reputation. In order to achieve this, you’ll need to warm up new email domains to ensure that you can build trust with inbox providers which will help in your deliverability rates.

However, fintech companies face unique challenges when warming up a domain. The industry is highly regulated, financial communications are sensitive, and spam filters are becoming increasingly sophisticated, so starting off too hot or too fast will lead to your emails landing in spam or being blocked for good.

In this article, we’ll discuss the amount of time it typically takes for a fintech to warm up a new email domain—usually, anywhere from two to six weeks—and why this time frame is paramount. We’ll also share best practices tailored for the fintech sector so you can get started right away.

Why domain warm-up is critical for fintech companies

The high ROI of email marketing ($38 return for every $1 spent) is not the only reason why this is a must-have channel for fintech companies. For fintech, email is vital, as it allows for one-to-one direct communication—required for dealing with sensitive information.

Domain warm-up is more than just a technical step for fintech businesses. It sets the foundation for maintaining integrity, remaining in compliance, and safeguarding your brand and your customers. In a field where trust is everything and regulations are strict, warming up your domain properly is key in preventing deliverability issues that can threaten your communication and reputation.

🔖 Related Reading: The Ultimate Guide to Understanding and Improve Domain Reputation

Builds trust with inbox providers in a regulated industry

Gmail, Outlook and Yahoo, among other mailbox providers, have advanced algorithms that assess sender reputation and decide which emails should make it to your recipients’ inbox. For fintech businesses who work in a highly regulated and sensitive area, reputation is even more important. Emails are subject to review to make certain that they are from known, reputable senders to prevent scams and fraud.

This trust has to be built through a warm up process that showcases responsible sending. A properly warmed-up domain demonstrates to inbox providers that your emails are authentic, secure, and valued by recipients. This reputation is key for ensuring your emails bypass spam filters and get to the recipient’s inbox with consistency.

Q: What are spam filters?

A: These are automated systems used by email service providers to pinpoint and block unwanted or harmful emails from reaching users’ inboxes. They review different factors like the reputation of the sender, the email content and user actions to decide whether a message is likely to be spam.

🔖 Relevant Reading: Spam filters: everything you need to know

Protects against financial phishing risks

Phishing and spoofing attacks targeting financial services are on the rise. And to describe exactly how big of a threat we’re talking about, here are some of the statistics from AAG’s latest report:

- The average cost of a data breach against a company exceeds $4 million.

- Google thwarts some 100 million phishing emails each day.

Additionally, 74% of organizations reported email phishing as the top method of attack and 31% of all phishing attacks in the world targeted financial institutions.

With such numbers, it’s no wonder that ESPs and companies in general are taking even more draconian measures towards security and filtering. Due to such a strong policies, also legitimate email senders can be categorized as a spam or suspicious. This is where email warm-up comes in—to help you get a good and trusted sender reputation.

When your domain consistently sends reputable, highly-engaged emails through a legitimate warm up process, email service providers are more able to recognize that your messages are authentic and not spoofed or malicious. This lowers the possibility of your emails being confused for phishing ones, which can save both your and your recipients’ brand from fraudulent activities.

Ensures compliance with email regulations

Fintech companies must also navigate strict email marketing and communication regulations such as the General Data Protection Regulation (GDPR) in Europe and the CAN-SPAM Act in the United States. These laws require clear consent from recipients, transparent communication practices, and easy unsubscribe options.

Proper domain warm-up supports compliance by encouraging responsible sending patterns that reduce spam complaints and respect user preferences. It ensures that your emails are more likely to be welcomed by recipients and that your agency or company avoids legal risks associated with unsolicited or poorly managed email campaigns.

Typical timeline to warm up an email domain in fintech

Warming up a new email domain is not an exact science—various factors influence the time it takes to build a solid sender reputation. However, having a clear estimate helps fintech companies plan outreach campaigns, set realistic expectations, and avoid costly deliverability setbacks. Generally, warming up a domain takes between two to six weeks, but this timeline can extend depending on specific circumstances.

Standard warm-up duration (2 to 6 weeks)

- Domains with prior reputation or moderate sending history: If you have a fintech domain with some sending history, warming up will typically take 2-3 weeks. Over this time, ramp up email volume while keeping engagement rates high. This slow, steady path allows inbox providers to trust you over time.

- Brand new domain or dormant domains: For completely new or inactive fintech domains, warm-up can extend to up to 6 weeks or more. This longer time frame ensures that the volume spike doesn’t set off spam filters and shows the mailbox providers that you are practicing steady and responsible sending.

🔖 Related Reading: The Warmy Research Team released a comprehensive report on different email platforms and diverse domain configurations and how they affect warm-up. Access the complete report here: The Science and Process of Warming Up Newly Created Email Domains

Factors that can extend warm-up time

There are a few reasons why it might take longer for a fintech email domain to get warmed up properly. Knowing these will enable you to better plan and not fall into the same traps that slow down trust on the inbox provider side.

Strict financial compliance requirements

Fintech communications are heavily regulated to protect consumers and prevent fraud. Inbox providers apply heightened scrutiny to emails from financial sectors, often enforcing stricter filtering rules. This means your email warmup process must be slower and more deliberate to demonstrate compliance and build trust gradually without triggering spam filters.

Low initial engagement

Email providers rely heavily on user engagement signals such as opens, clicks, and replies to assess sender reputation. If your early warm-up emails fail to engage recipients, providers may hesitate to increase inbox placement or allow higher sending volumes. Maintaining relevant, personalized content during warm-up is crucial to encourage positive interactions.

🔖 Related Reading: Boost Your Email Click-Through Rate and Skyrocket Engagement

Previous reputation issues or blacklisting

Domains or IP addresses with a history of poor deliverability, spam complaints, or inclusion on blacklists require additional time to regain trust. Providers track past behavior, and any negative record can significantly slow the warm-up process as you rebuild your sender reputation from the ground up.

🔖 Related Reading: Are Blacklists Killing Your Emails? A Deep Dive into How They Influence Email Providers is a report from the Warmy Research Team detailing how different providers use third-party blacklists in their algorithms.

Volume and frequency mismanagement

Rapidly increasing email volume or sending inconsistent amounts can raise red flags with inbox providers. Sudden spikes in volume are often interpreted as spam-like behavior. Proper warm-up requires carefully controlled, incremental volume increases paired with consistent sending schedules to avoid penalties.

Mailbox provider (e.g., Gmail, Outlook)

Different mailbox providers have varying filtering algorithms and tolerance for new senders. For example, Outlook’s filters may be stricter compared to others, affecting the pace at which your emails gain trust and achieve inbox placement.

Content quality and engagement

High-quality, relevant email content fosters recipient engagement, which positively influences sender reputation. Low-quality or irrelevant content can lead to higher spam complaints or unsubscribes, lengthening the warm-up timeline.

Technical setup (SPF, DKIM, DMARC)

Proper email authentication through SPF, DKIM, and DMARC is foundational. Incorrect or missing configurations increase the chance of emails being flagged as suspicious or rejected, requiring a longer warm-up to overcome these technical barriers.

Best practices for warming up a fintech email domain

Warming up an email domain properly is essential to establish a positive sender reputation and maximize deliverability, especially in the highly regulated fintech sector. Implementing these best practices will help fintech companies build trust with inbox providers while protecting their brand and compliance posture.

Start with low send volumes

Begin your warm-up by sending a small number of emails per day—typically between 10 and 20. Starting low minimizes the risk of triggering spam filters and allows mailbox providers to observe consistent, responsible sending behavior. This cautious approach is critical in fintech, where providers closely scrutinize new senders.

Tips:

- Target highly engaged contacts first to boost positive signals.

- Avoid sudden volume spikes in early stages.

- Monitor metrics daily to catch issues quickly.

Gradually increase email frequency and volume

After establishing a steady initial send rate, slowly increase your email volume and frequency over several weeks. This gradual ramp-up demonstrates to inbox providers that your domain is a legitimate sender with a stable pattern.

Tips:

- Increase volume by no more than 20-30% each week.

- Maintain consistent sending times to build predictability.

- Adjust based on engagement and bounce rates.

Create personalized and relevant content

Fintech recipients expect precise, trustworthy communications relevant to their needs and compliance requirements. Personalized content not only improves engagement but also signals to providers that your emails are valued, enhancing deliverability.

Tips:

- Use dynamic content based on user behavior or preferences.

- Include compliance disclaimers when appropriate.

- Avoid generic or overly promotional language that can trigger spam filters.

Leverage AI-powered warm-up tools

AI-driven platforms like Warmy.io automate and optimize the warm-up process by adjusting sending volume, timing, and engagement based on real-time data. These tools reduce manual effort and increase the effectiveness of your warm-up strategy.

Benefits:

- Tailored warm-up plans designed for fintech domains.

- Real mailbox interactions generating genuine engagement signals.

- Continuous monitoring and access to comprehensive insights to maintain deliverability health.

How Warmy.io helps fintech companies with email warm-up

Warmy.io offers fintech companies a powerful, AI-driven platform designed to simplify and optimize the email domain warm-up process. Its features address the unique challenges fintech businesses face, ensuring safe, compliant, and effective email outreach.

AI-driven warm-up process with customizable features

Warmy.io uses artificial intelligence to create personalized warm-up schedules tailored to your domain’s age, sending history, and compliance needs. You can choose from over 30 languages.

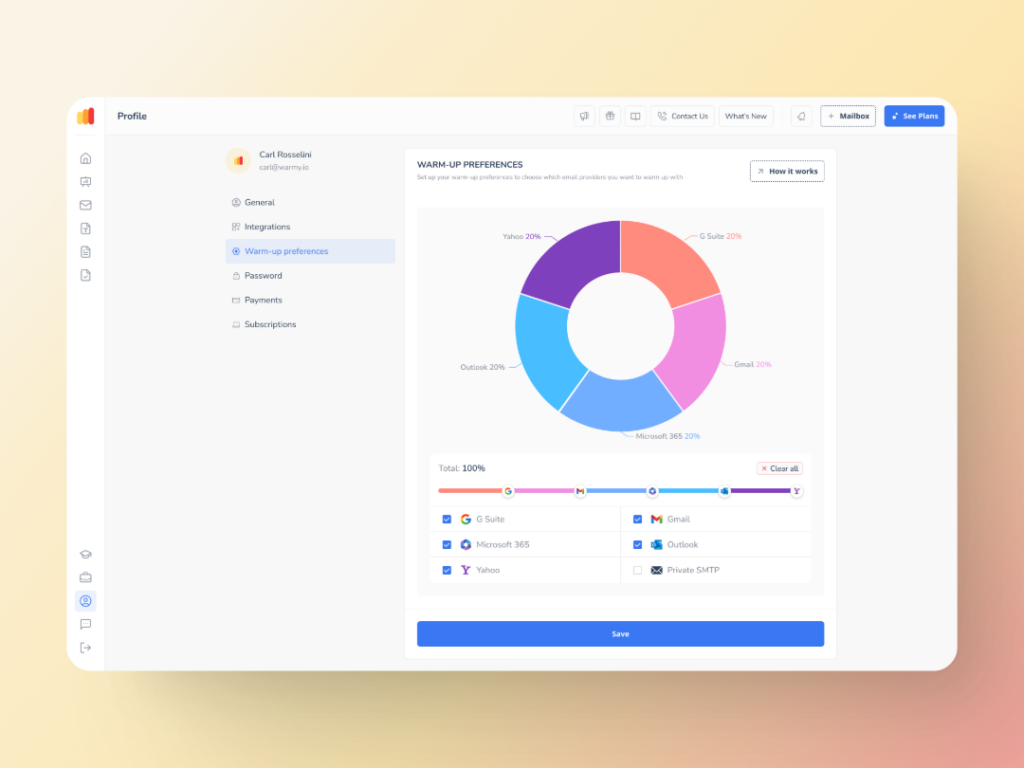

The Warmup Preferences feature allows senders to customize the warmup distribution across providers and select B2B engagement patterns over B2C—allowing you to align warm-up emails with your fintech brand voice and regulatory requirements.

Real mailboxes, real interactions, real results

Unlike automated bots or fake accounts, Warmy’s advanced seed lists are real email addresses. This generates genuine engagement signals such as opens and replies, which inbox providers value highly when assessing sender reputation.

Domain Health Hub

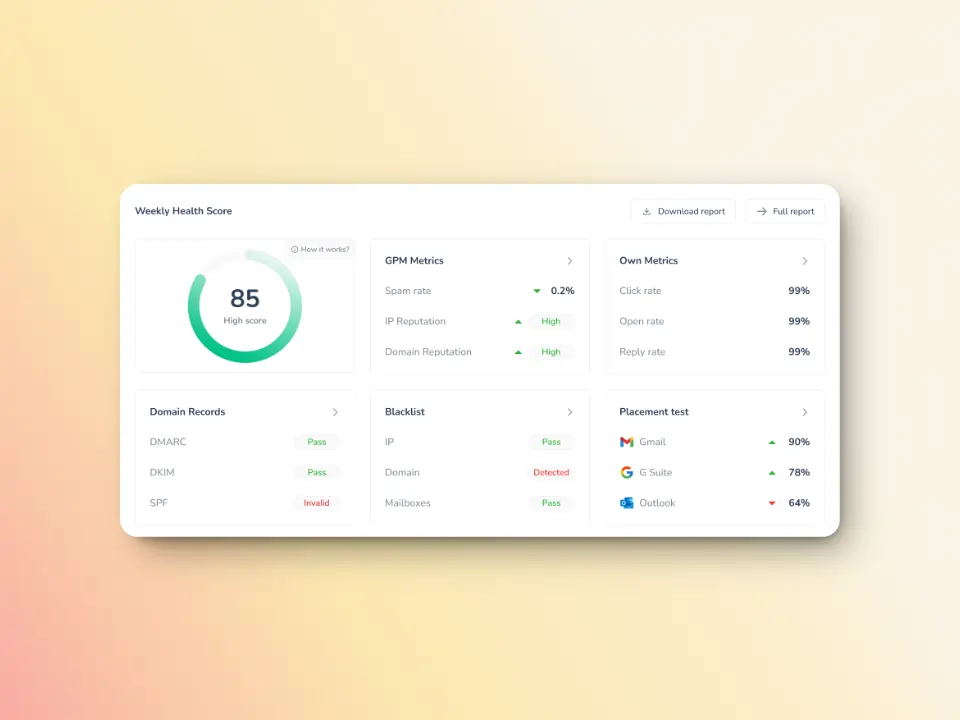

Warmy.io’s Domain Health Hub provides a domain-level health dashboard with the following features:

- A domain health score based on various factors like authentication, blacklist status, and inbox placement tests.

- Weekly and monthly tracking options for spam rate trends and overall deliverability performance

- Comprehensive DNS status checks to easily validate SPF, DKIM, DMARC, rDNS, MX, and A records for stronger authentication & security.

- Optimized multi-domain monitoring so users can manage all their domains from one dashboard and identify which ones need immediate attention.

Start warming up your fintech domain the right way

Warming up an email domain is a critical step for fintech companies aiming to build trust, ensure compliance, and achieve high email deliverability. Given the sector’s unique challenges—from strict regulatory demands to heightened scrutiny around phishing—taking a careful, data-driven approach over two to six weeks is essential.

Avoid costly deliverability issues that can damage your brand and customer trust. Use Warmy.io to automate and optimize your email warm-up, monitor your domain’s health, and maintain compliance with ease. Book your demo today and begin your warm-up journey to set your fintech company up for long-term email success.